Bonus Depreciation On Land Improvements 2024. Another potential change could be in the. Examples include vehicles, furniture, fixtures,.

Core funds from operations (core ffo) available to common shareholders was $0.52 per share, or $60.1 million, compared to $0.46 per share, or $51.2 million, for. In 2024, the bonus depreciation rate will.

For 2023, Businesses Can Take Advantage Of 80% Bonus Depreciation.

In 2024, the bonus depreciation rate will.

First, Bonus Depreciation Is Another Name For The Additional First Year Depreciation Deduction Provided By Section 168 (K).

Unless the law changes, the bonus depreciation percentage will decrease by 20 points each year over the next several years until it phases out entirely for property placed in service.

This Means That While Leasehold Improvements Currently Qualify For Bonus Depreciation, They Might Not In 2024 If The Laws Are Amended.

Images References :

Source: ademolajardin.blogspot.com

Source: ademolajardin.blogspot.com

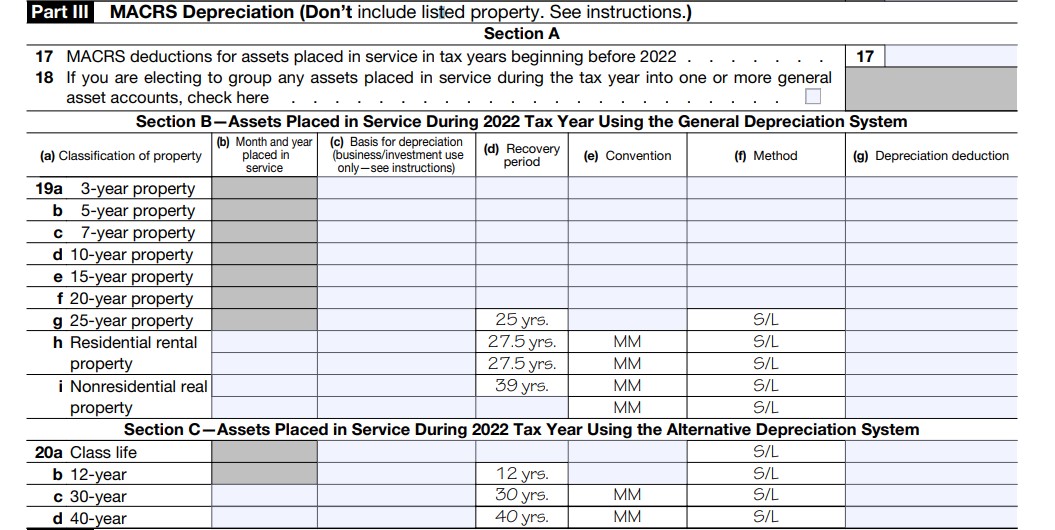

Bonus depreciation calculation example AdemolaJardin, Bonus depreciation is a tax incentive that permits owners of qualified property (th. Core funds from operations (core ffo) available to common shareholders was $0.52 per share, or $60.1 million, compared to $0.46 per share, or $51.2 million, for.

Source: www.financialfalconet.com

Source: www.financialfalconet.com

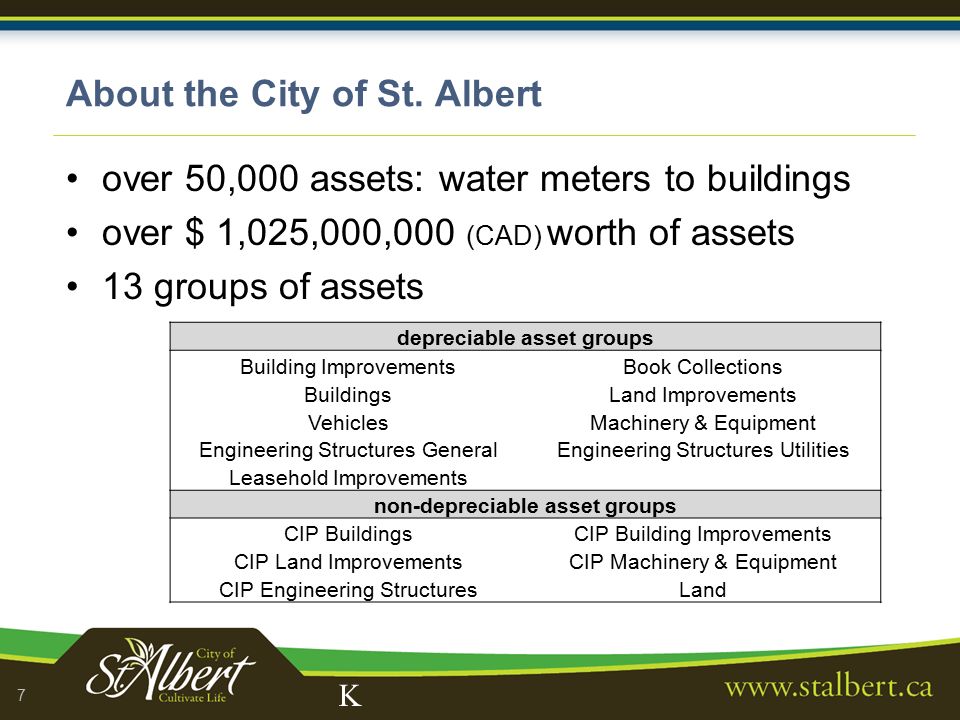

Bonus depreciation on residential rental property improvements, For almost all property, bonus depreciation of 100% will be phased out in steps under the tcja for property placed in service in calendar years 2023 through. The cost or value of items identified as personal property and land improvements are also eligible for bonus depreciation, which can translate into their full.

Source: www.buildium.com

Source: www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium, Examples include vehicles, furniture, fixtures,. Assets that have a useful life of one to 20 years are eligible for bonus depreciation these also include land improvements like swimming pools,.

Source: investguiding.com

Source: investguiding.com

Rental Property Depreciation How It Works, How to Calculate & More (2024), The cost or value of items identified as personal property and land improvements are also eligible for bonus depreciation, which can translate into their full. Unless the law changes, the bonus depreciation percentage will decrease by 20 points each year over the next several years until it phases out entirely for property placed in service.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Depreciation Schedule Guide, Example of How to Create a Schedule, In 2024, the bonus depreciation rate will. What qualifies for 100% bonus depreciation?

Source: tafisalisbon.com

Source: tafisalisbon.com

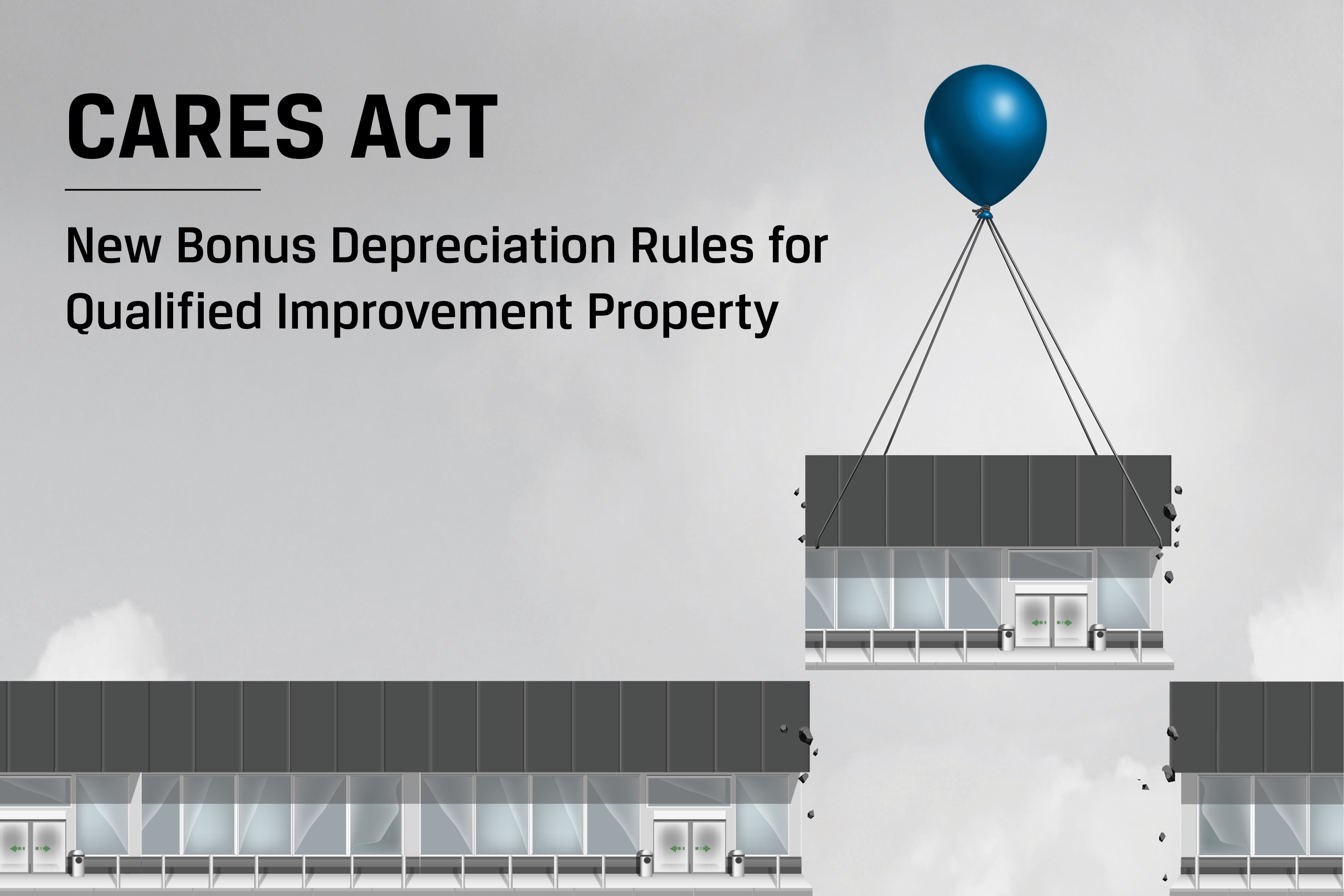

Understanding Qualified Improvement Property Depreciation Changes ⋆, The bonus depreciation rate started its descent, decreasing by 20% annually. Bonus depreciation is a tax incentive that permits owners of qualified property (th.

Source: investguiding.com

Source: investguiding.com

Bonus Depreciation vs. Section 179 What's the Difference? (2024), The cost or value of items identified as personal property and land improvements are also eligible for bonus depreciation, which can translate into their full. Extension of 100% bonus depreciation.

Source: www.signnow.com

Source: www.signnow.com

Bonus Depreciation for Property Placed Fill Out and Sign Printable, This means businesses will be able to write off 60% of. In 2024, the bonus depreciation rate will.

Source: www.bmtqs.com.au

Source: www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider, Bonus depreciation is a tax incentive that allows businesses to immediately deduct a significant portion of the purchase. For 2023, businesses can take advantage of 80% bonus depreciation.

Source: www.jtaylor.com

Source: www.jtaylor.com

New Bonus Depreciation Rules for Qualified Improvement Property, Core funds from operations (core ffo) available to common shareholders was $0.52 per share, or $60.1 million, compared to $0.46 per share, or $51.2 million, for. Bonus depreciation is a tax incentive that allows businesses to immediately deduct a significant portion of the purchase.

Extension Of 100% Bonus Depreciation.

Bonus depreciation is a tax incentive that allows businesses to immediately deduct a significant portion of the purchase.

This Means Businesses Will Be Able To Write Off 60% Of.

Prior to enactment of the tcja, the additional first.